How to budget for delayed GST or VAT

Revenue is recognised on the profit and loss / income statement, but GST (or VAT) is required to be recognised only in the month in which the cash is received.

Answer

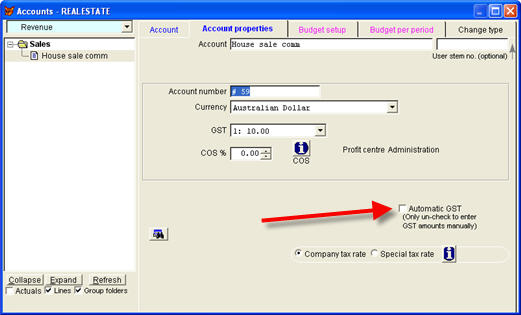

To budget for delayed GST or VAT go to the Account, then to the Account property page.

Automatic GST / Automatic VAT / Automatic SALES TAX – normally this box is checked. Most users will never change this setting. In this case we want to enter the GST / VAT / SALES TAX amounts manually, so uncheck this box. See picture:

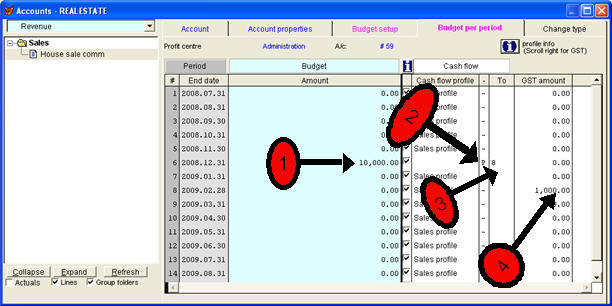

When Automatic GST or VAT is turned off, the GST / VAT will not be added automatically. Instead, the Budget per period page will display an extra column for entering the GST / VAT / SALES TAX amount yourself. See marker 4 is picture

GST amount or VAT amount or Sales Tax amount – this column is normally not shown. The only circumstance in which it appears in the grid on the Budget per period page is if the user unchecked the Automatic GST/VAT/SALES TAX checkbox on the Account properties page.

The picture is now explained using the markers 1 to 4:

1.

*An amount of 10,000 is recognised as revenue in period 6.

* Notice the P. The ‘P’ is used when you want the cash flow to be received in a Nominated period.

Note: we are using the P option here because it clearly explains the process, and is often useful when entering the GST or VAT manually.

*The Nominated period is shown in the To column. In the example, 10,000 of revenue recognised as income in period 6 will be paid in period 8. So 10,000 cash will be collected in period 8.

*THE GST or VAT amount is shown in period 8. So the GST (or VAT) of 1,000 is charged in period 8.

Note: The usual sales profile could also have been used (“-“) to show when the income is recognised. The GST or VAT would still have been entered into the column as shown in 4.

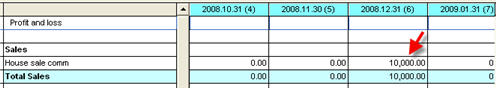

Here are the results for this example:

Profit and loss / income statement:

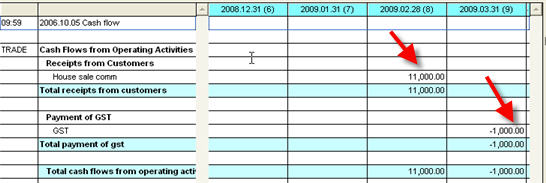

Cash Flow:

In period 8 the income of 10,000 plus the 1,000 GST or VAT is received. Total 11,000.

In period 9 the GST or VAT is sent off to the tax office.

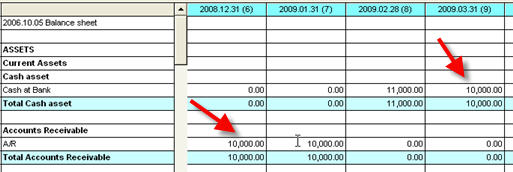

Balance sheet

The 10,000 is shown as A/R on the Balance sheet, and stays there until paid in period 8.

Cash at bank is 11,000 in period 8, and this reduced in period 9 by the 1,000 GST or VAT sent to the tax office.